Mar 05, 2019

Banks have been at it for quite some time now. Global remittances have pretty much embraced it as the next big thing. Insurance and Actuaries are in mutual agreement about its huge potential. The technology itself was the instrument that the inventors used to deliver digital currencies to the world. Crypto Winter notwithstanding, blockchain has been intricately tied to the finance world and being hailed as the future of money by cultists has implications far more prominent than what appears at the outset.

Little wonder, then, that the global securities trade is looking at an imminent blockchain disruption at an unprecedented scale any day now, and the advantages are seriously unfair for early movers. Digital assets are here to stay, and for the securities board CEO looking to implement blockchain for accelerating trade settlements, remove numerous intermediaries in processes and drastically reduce IT and operating costs, the business case is compelling, to say the least.

Early Movers

Securities boards across different countries are already on the verge of blockchain adoption. Examples include biggies like Nasdaq, ASX, NYSE, SEBI in India and the Tokyo Stock Exchange in Japan. They’re either already using components or the entire stack of the technology, or have already appointed committees to evaluate the potential impact that blockchain can have on their businesses.

In a recent report, the World Economic Forum projected that 10% of the global GDP will be stored on blockchain technologies by 2027 – that’s less than a decade away. One of the highest impact areas within finance in the report states automated market index data and OTC derivatives, mixed with futures trading, while cash equity trading appears slightly lower on the impact index. But given the fact that 2017 saw more than $1bn of venture capital flowing into blockchain startups, and that most of these were financial services, the numbers speak of the prominence of blockchain in the fintech segment eloquently enough.

The Unfair Advantages

At a micro level, the advantages of blockchain in global securities markets, if implemented at par with business needs, are numerous and highly impactful. Security, accuracy and efficiency top the list of priorities for those in the implementation stages, while other functions also form a high priority list for securities exchanges across the world.

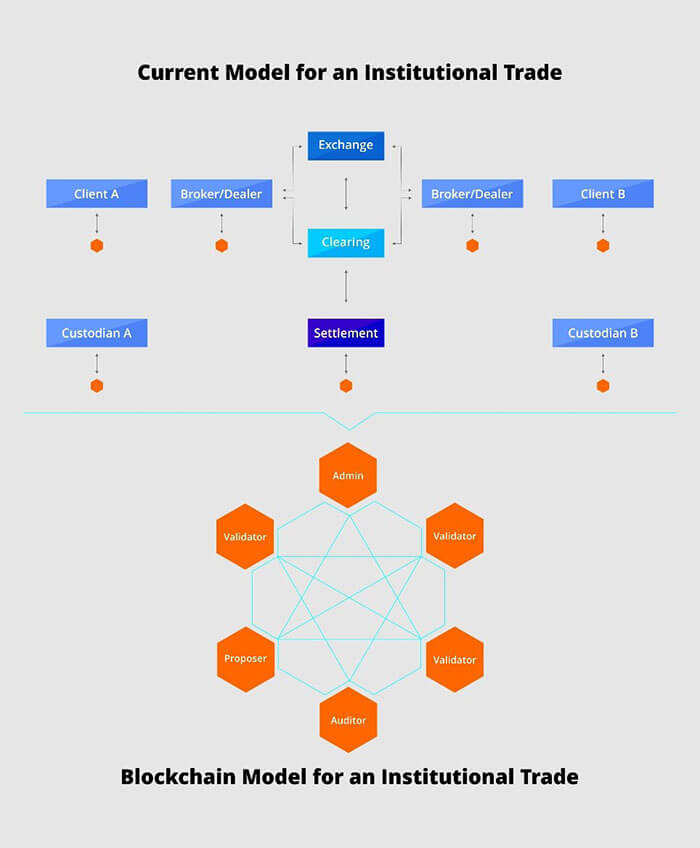

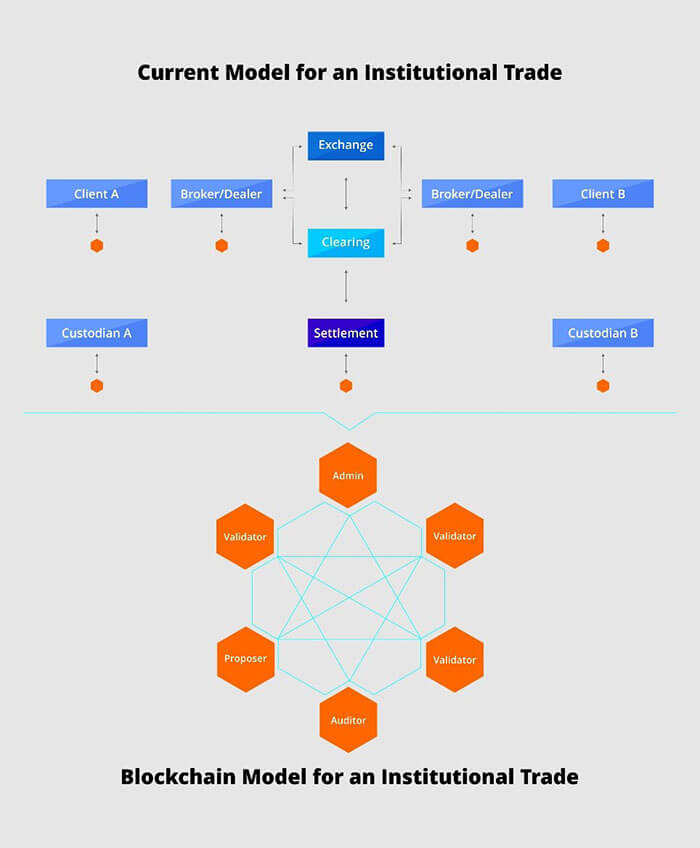

In a recent survey, industry leaders voted clearing and settlement as the highest priority, with 31% of the respondents affirming its importance. This was followed by accuracy in reference data provisions at 24%, trade matching and confirmation at 11%, collateral management at 10%, complex OTC derivatives processing at 3%, security issuances at 3% and other implementation areas at 16%. So how would these change? A radical shift in the current model for institutional trade vis a vis a blockchain powered trade model speaks volumes on the impact potential.

The Brass Tacks

Its beyond obvious that global securities markets comprise a complex financial ecosystem. Within this, the components that are the most likely to be impacted include –

Cash Equity Settlements – A drastic reduction with a probable instant settlement cycle will impact traders, investors and institutions alike.

Fixed Income – Smart contracts implementation for validation of fixed income assets will ensure accurate processing with zero intermediaries. The resultant cost efficiencies are fairly obvious.

Derivatives : OTC and Exotics – Automation of settlement and matching with smart contracts will again remove intermediaries and execute even the most complex derivative trades flawlessly.

The early adopters have made their move. Blockchain has proved its mettle and is at the cusp of going mainstream in global securities. The time is ripe for building lucrative, rewarding careers in this exciting new domain. Make your move.