Jul 29, 2020

What if everyone could advance their financial transactions without data security problems and reconciliations?

It would be an improved version of service efficiency and data credibility, and that’s how the future of digital finance will look like with blockchain technology!

Blockchain technology, which got its first public attention through the Bitcoin, is now the catalyst for the fourth industrial revolution and acknowledged as an important technological breakthrough. The transparent and immutable feature of blockchain technology is being recognized by various industries as it eliminates the need for complex paperwork while building trust among the participating parties.

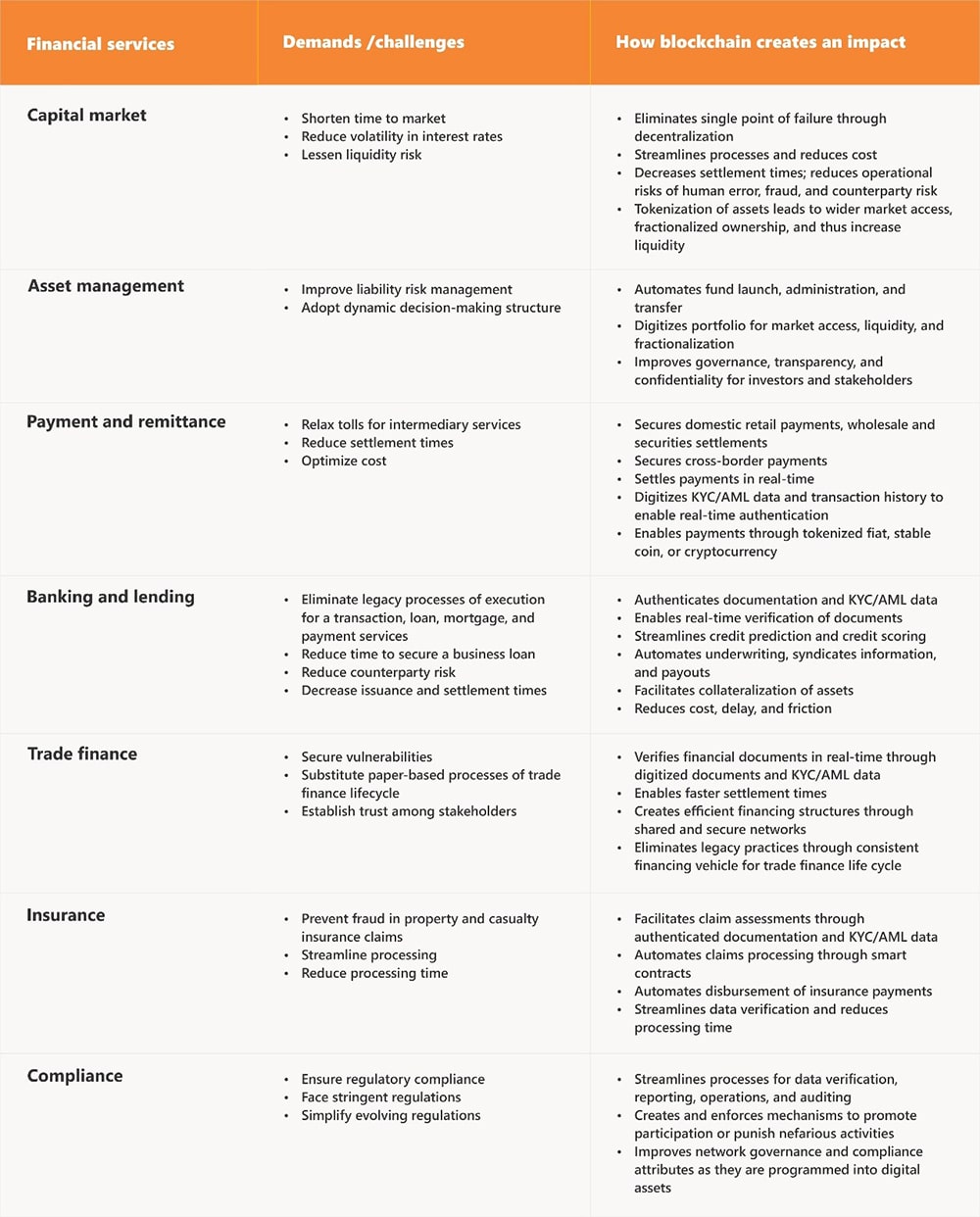

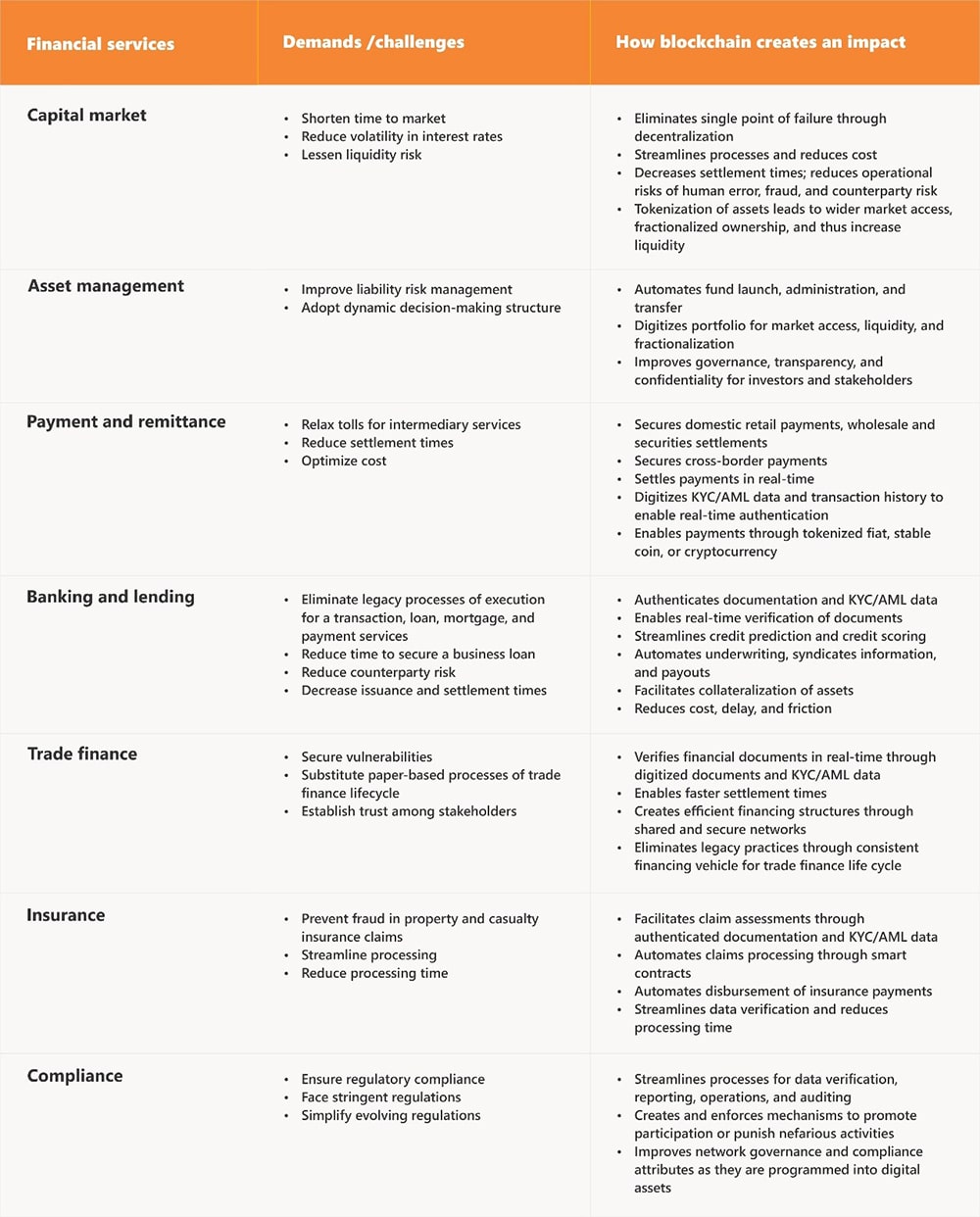

In the financial sector, in particular, every aspirant has begun to experiment with blockchain technology in financial instruments like day-to-day transactions, Know Your Customer (KYC) processes, and equities.

Bruce Weber and Andrew Novocain rightly say, ‘any financial operation with low transparency and limited traceability will get disrupted by blockchain applications.’

In the era of digitalization, where digital finance is becoming the rule, blockchain application is like a jewel in the crown.

Blockchain technology in digital finance: The evaluation

With blockchain, the next edge of digital finance is here. Take a look.

Blockchain technology and digital finance: The new benefits

Blockchain, through its market-leading tools for granular data privacy, allows selective sharing of data in business networks. It blocks identity theft, prevents tampering, stops Denial of Service attacks (DDoS), decentralizes and distributes data across the network cryptographically and thus, makes the financial system more robust.

Blockchain technology maturity is at enterprise-grade level creating a big impact on the core processes. With blockchain, we can expect:

Reduction in reconciliation and errors

The distributed consensus-based architecture eliminates single points of failure. It reduces the necessity for data intermediaries like messaging system operators or transfer agents. Studies suggest that there would be a 95 percent reduction in reconciliation and errors as the immutable records show compliance through an audit trail.

Improvement in data efficiency and digitization

Transparency and digitization will lead to a 40 percent increase in its efficiency. The trades will be straight and settled faster freeing up to 75 percent capital consumption.

Progression in customer experience, new markets, and revenue

The use of digital channels, faster processing, and shared information with vendors and clients enable financial services to get quicker and also find new business opportunities. Financial sectors can expect up to 25 percent increase in revenue owing to better customer experience and new markets.

Refinement in trust, security, and privacy

Financial sectors may start with private blockchain initially, and then switch to the public to retain sensitive data. Eventually, they can add permissioned blockchain for partners and customers also.

Blockchain-enabled digital finance: Interesting statistics

- 24% of financial executives are conversant with blockchain technology, PwC reports.

- 77% of fintech will have blockchain-enabled services in their production system by 2020.

- Financial institutions have spent USD 552 million on blockchain projects.

- Blockchain innovation leader, ING has assumed a seat on the Global Digital Finance (GDF) Advisory Council to accelerate the adoption of digital assets.

Blockchain-enabled digital finance world: The way ahead

We will continue to see fintech industries actively testing ways to reap blockchain benefits. It is estimated that the business value added by blockchain will surpass USD 176 billion by 2025 and USD 3.1 trillion by 2030.

All these and more industrial usages has led to a high demand for experienced blockchain developers and it is the trend for 2020 and beyond.

Does this encourage you to jump into the world of blockchain?

If yes, learn blockchain to get on with the trend and make a futuristic career.

Earning blockchain certification is the best way to move forward. Get certified to gain new and trending skills!